Your insurance coverage company will pay the continuing to be balance of $500 to the garage. Given that you have actually picked a $500 deductible, you will certainly be accountable for the costs.

It's not part of the costs. When you pay your insurance policy costs, you aren't adding to a savings account against future losses. While the quantity of your insurance deductible can elevate or decrease your costs, insurance deductible and costs are 2 different things. It's not something that the insurance policy firm pays. The named insured on the plan is accountable for paying the insurance deductible amount. cars.

This indicates that even if a person else was driving your automobile and entered a mishap, your insurer would handle the insurance claim and also you would certainly be responsible for your plan deductible. It's not the same as a medical insurance deductible. Deductibles for wellness insurance policy policies commonly cover an entire year, meaning you would only pay up to the quantity of your deductible (i.

However, an auto insurance coverage deductible uses "per incident." This indicates you are in charge of your complete deductible amount each time you endure a covered loss. As with all points insurance policy, it's finest to go over deductibles as well as exactly how they use in your circumstance with a local independent insurance policy agent. Your regional independent agent has the expertise as well as experience to answer often asked inquiries concerning deductibles and compute cost financial savings for you relying on the deducible amount you choose.

Not known Factual Statements About How To Choose The Right Car Insurance Deductible - Metromile

Inevitably, exactly how much security you have as well as what you pay out-of-pocket are based on the kind of protection you obtain and also the automobile insurance coverage deductible you select.

Locate out what to take into consideration when choosing a vehicle insurance coverage deductible for your needs, budget, and also lifestyle. An automobile insurance policy deductible refers to the total quantity a policyholder pays out-of-pocket before the insurance coverage covers a professional occurrence.

What makes car insurance protection various from other kinds of insurance policy is that you are accountable for paying the insurance deductible each time you sue. affordable. Just how does a cars and truck insurance deductible work? If you enter a vehicle crash or other sort of case covered under your plan, you'll require to submit an insurance claim.

You might additionally pay the deductible directly to the fixing shop fixing your vehicle. Your car insurance coverage deductible is your responsibility and has to be paid before your insurance coverage company covers the remainder. What are deductibles based off of? As a consumer, you can usually select a higher insurance deductible and score a lower auto insurance costs. cheaper car.

The Basic Principles Of Auto Insurance Tips – What Is Car Insurance Deductible?

However if any type of damage or repair services are much less than the expense of your insurance deductible, then it's unworthy filing a case. On the various other hand, if you select a reduced car insurance policy deductible in between $100 and also $500, the chance of you filing a case goes up. That implies you'll likely pay a greater monthly costs and also be taken into consideration even more of a threat to your insurance coverage company. prices.

When do you pay the insurance deductible for vehicle insurance? You don't need to pay your auto insurance policy deductible when selecting an auto insurance plan - insurers. Instead, you pay your cars and truck insurance coverage costs. You need to pay your cars and truck insurance deductible when you make a claim. The vehicle insurance coverage deductible can be payable to either your fixing shop or your insurance carrier, relying on the amount, your plan, and your provider's general insurance deductible plan.

Bear in mind, inevitably, paying your deductible is up to you. If you prefer to not submit a case, you do not have to pay your insurance deductible, but you will be responsible for the entire expense of your repair service. What are the various types of automobile insurance coverage deductibles? When you pick a vehicle insurance coverage, you register for a particular kind of insurance coverage that can aid out in specific circumstances - cheapest car.

Comprehensive coverage Comprehensive coverage covers the cost of repairing or changing your car in circumstances beyond a standard crash. If your car obtains damaged in a freak hailstorm or hit by a deer, or ends up being taken, comprehensive protection will certainly come to the rescue. This sort of coverage is generally sold in tandem with accident insurance coverage.

Deductible In Car Insurance - Bharti Axa Gi Fundamentals Explained

It doesn't matter whether you're discovered at-fault or otherwise. This sort of protection helps cover the price of repairs or any kind of needed replacements if there's an occurrence. Without insurance and underinsured protection An additional kind of coverage is uninsured as well as underinsured insurance coverage. In case you enter into a crash with an uninsured vehicle driver or one with limited insurance coverage, this kind of insurance can aid cover expenses.

This might not be offered in every state or by every insurance coverage company.

If you pick a lower auto insurance coverage deductible quantity, it's most likely your costs will be greater. While you're paying much more now, if something takes place down the line and you enter an accident, you'll pay much less out-of-pocket then. Your deductible amount ought to be something you feel comfortable paying or have simple access to in a reserve, or as a last resource, a credit line. cheapest car insurance.

On the other hand, extensive as well as crash insurance can cover mishaps, theft, as well as weather events that can come out of nowhere. You can pick the deductible amount for each kind of protection, so if you assume you are a safe chauffeur, it could make sense to have a higher accident deductible (where you can usually prevent a crash) versus thorough (where the events are generally out of our control).

3 Simple Techniques For Should I Have A $500 Or $1000 Auto Insurance Deductible?

That means considering your danger levels, requirements, financial resources, as well as much more. You also desire to make certain you have the appropriate protection to protect yourself in various situations. If you're still paying for miles you aren't driving, it's time to rethink your auto insurance coverage.

If you make use of the conventional gas mileage price, you can not deduct automobile insurance coverage premiums as a separate cost. You can still deduct tolls and parking fees. This consists of car insurance as well as the various other things listed above - cars. If you're uncertain which one you wish to make use of, or which might allow you deduct extra, it might assist to review the gas mileage reduction guidelines.

Nonetheless, several people make use Click for more info of a personal auto for both personal as well as company functions. To determine what puts on your taxes, you'll split the expenses in between individual and also organization use based upon the miles that you drive. If 70% of the miles you drive are for business, and the other 30% are for individual, you'll usually be able to apply 70% of your costs to your deduction.

A deductible is what you pay out of pocket to fix your vehicle before your vehicle insurance pays for the remainder. If you bring extensive and also crash insurance coverage on your auto insurance coverage, you will certainly see an insurance deductible noted on your policy as a dollar quantity. trucks.

The Greatest Guide To What Is An Insurance Deductible? - Ramseysolutions.com

When do you pay your insurance deductible? You only pay the insurance deductible for fixings made to your own lorry.

Just how much will you conserve yearly on premiums? Would certainly these financial savings make a significant effect on your spending plan? This is where the worth of your vehicle can be a large element. More recent lorries are extra pricey to replace than older cars. For that factor alone, you might see a large rate dive in your premium if you select the lower deductible.

If you're still leaning towards a greater insurance deductible, think regarding this: Exactly how long would it take to recoup what you'll invest on premium prices? If it's just going to take you a year or 2, the greater deductible might still be looking excellent - car insured. Otherwise, the lower deductible may make more sense.

Assume about exactly how you utilize your automobile. If you live in a peaceful community with a quick commute to work, you may be comfy with a higher insurance deductible (auto). Be sure and talk to your ERIE representative to assist you identify which plan is appropriate for you.

Should I Have A $500 Or $1000 Auto Insurance Deductible? Can Be Fun For Anyone

In this write-up: When you file a case with your vehicle insurance provider, you might have to pay a deductible. This is the amount you pay out of pocket prior to your insurance policy protection begins. Not all coverage types call for a deductible, but those that do enable you to choose what the amounts will certainly beand that will certainly have a result your insurance plan's month-to-month payment.

What Is a Car Insurance Policy Deductible? If you have health and wellness insurance, you've probably managed deductibles before. Essentially, it's what you are needed to pay out of pocket when you submit a claim, up until you reach your insurance deductible amount. Unlike health and wellness insurance coverage, with car insurance you don't have an insurance deductible that resets every year.

As an example, allow's claim you trigger an automobile mishap, and the overall damage to your lorry is $10,000. If you have a $1,000 deductible, you'll need to pay that amount, after that your insurance provider will cover the continuing to be $9,000. If your car is amounted to and also the insurer cuts you a check for the worth of the automobile, it'll be decreased by that $1,000 deductible.

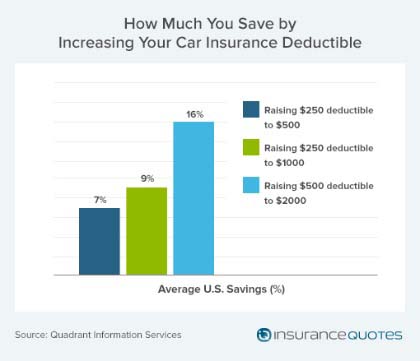

Selecting a greater insurance deductible minimizes the insurance company's price if you sue, so you'll pay a reduced premium. In comparison, a reduced insurance deductible minimizes your out-of-pocket prices if you have a claim, but will cause a greater price. If you're getting auto insurance policy prices estimate from different providers, you can try different deductibles to see just how your price is affected (credit score).

Facts About Deductible For Car Insurance - Plymouth Rock Revealed

What Sort Of Car Insurance Policy Protection Call For a Deductible? Deductibles are most common with accident and detailed coverage. In some states, however, you might additionally have a deductible for injury security or uninsured/underinsured motorist property damages coverage.: If you strike another vehicle or an object, accident coverage will certainly assist spend for repair work (car insured).

Deductibles are common for this sort of coverage as well as also vary by insurer.: Also referred to as PIP, this coverage pays medical bills, funeral service costs, childcare costs, lost wages as well as various other similar costs, despite who triggered the mishap. PIP is not offered in all states and also where it is readily available, it may be needed or optional.

Insurance deductible demands can also differ by state. What to Consider When Picking Your Vehicle Insurance Deductible, Choosing a deductible for your car insurance plan can be a demanding experience.