There is no one-size-fits-all as well as whichever you determine on, make sure the deductible quantity best fits your circumstance. Does Insurance Policy Pay Back Your Deductible?

trucks low cost auto car affordable

trucks low cost auto car affordable

low-cost auto insurance cheaper cars insurance affordable accident

low-cost auto insurance cheaper cars insurance affordable accident

Eventually, just how much protection you have as well as what you pay out-of-pocket are based on the type of coverage you obtain and also the automobile insurance coverage deductible you select (cars).

Figure out what to think about when selecting a car insurance policy deductible for your requirements, spending plan, and way of life. car. What is an auto insurance policy deductible? A car insurance policy deductible refers to the complete quantity an insurance holder pays out-of-pocket before the insurance policy covers a certified occurrence. low cost auto. For instance, if you enter a fender bender that leads to $2,000 of repairs and also you have a $500 vehicle insurance policy deductible, you get on the hook for $500, and your auto insurance business will cover the staying $1,500.

What makes cars and truck insurance policy coverage various from various other kinds of insurance policy is that you are accountable for paying the insurance deductible each time you submit an insurance claim. How does an auto insurance deductible work? If you enter an automobile mishap or various other kind of incident covered under your policy, you'll need to submit a case. liability.

You may additionally pay the insurance deductible straight to the repair shop repairing your lorry. Your car insurance deductible is your responsibility and also has to be paid before your insurance coverage carrier covers the rest. What are deductibles based off of? As a customer, you can generally choose a greater deductible as well as rack up a reduced vehicle insurance coverage premium (suvs).

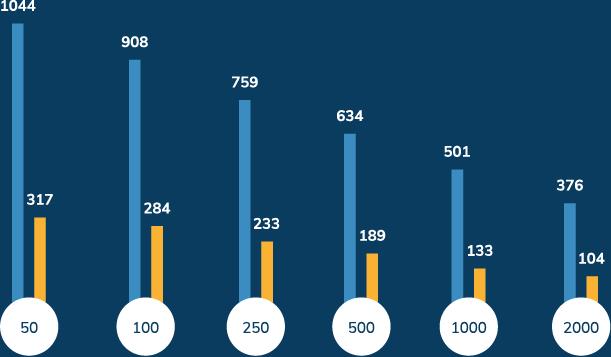

If any damages or repair services are much less than the expense of your insurance deductible, then it's not worth submitting a claim - cheaper car insurance. On the other hand, if you pick a reduced automobile insurance deductible in between $100 and also $500, the possibility of you suing increases (liability). That means you'll likely pay a greater month-to-month premium and also be thought about even more of a risk to your insurance coverage supplier.

The Single Strategy To Use For What Exactly Is An Auto Insurance Deductible?

When do you pay the insurance deductible for auto insurance? You do not have to pay your vehicle insurance policy deductible when selecting a cars and truck insurance plan. Instead, you pay your automobile insurance policy costs. You need to pay your auto insurance policy deductible when you make a case. The auto insurance deductible can be payable to either your repair work store or your insurance provider, depending on the quantity, your strategy, and your company's general deductible plan. suvs.

However keep in mind, eventually, paying your deductible is up to you. If you prefer to not send a claim, you don't need to pay your deductible, however you will be accountable for the whole cost of your repair service. What are the different types of car insurance deductibles? When you select a car insurance plan, you enroll in a specific kind of coverage that can assist in particular circumstances.

If your auto gets harmed in a freak hailstorm or struck by a deer, or ends up being taken, thorough insurance coverage will come to the rescue. This kind of protection is commonly offered in tandem with crash insurance coverage.

It matters not whether you're located at-fault or not. auto. This kind of protection aids cover the cost of repair work or any type of needed substitutes if there's an incident. Without insurance and underinsured coverage An additional sort of insurance coverage is without insurance and underinsured coverage. In case you get into a mishap with a without insurance vehicle driver or one with restricted protection, this kind of insurance policy can help cover costs.

insured car cheap low cost auto affordable auto insurance

insured car cheap low cost auto affordable auto insurance

This might not be offered in every state or by every insurance coverage carrier. Personal injury protection (PIP) Medical costs are a problem for many individuals. Injury security insurance can assist cover clinical expenses after an accident no matter who is found at-fault - insurance. Some states like New Jersey require this type of insurance as it's taken into consideration a "no fault" state.

If you pick a lower car insurance policy deductible quantity, it's likely your costs will be greater. While you're paying extra now, if something occurs down the line and also you get involved in an accident, you'll pay less out-of-pocket then. Your deductible quantity must be something you really feel comfy paying or have very easy accessibility to in an emergency situation fund, or as a last option, a line of debt.

Not known Incorrect View website Statements About What Is A Deductible? - Insurance Dictionary

For example, if you select liability-only that covers damages as well as injury costs for the other driver if you're at mistake. insurance. On the other hand, extensive as well as collision insurance can cover accidents, theft, and also weather condition occasions that can appear of nowhere. You can pick the deductible quantity for each and every sort of coverage, so if you assume you are a safe driver, it might make feeling to have a higher collision insurance deductible (where you can frequently prevent an accident) versus detailed (where the occasions are normally out of our control).

That means considering your threat degrees, needs, funds, and a lot more. You additionally intend to see to it you have the ideal coverage to protect on your own in numerous situations. And also if you do not drive significantly? You can pay less with pay-per-mile cars and truck insurance policy with Metromile. If you're still paying for miles you aren't driving, it's time to reconsider your auto insurance policy protection.

There are a few things to consider when picking your deductibles, such as your budget, the worth of your vehicle, just how much you have in savings that you can put towards vehicle repair work and the chance that you'll need to make a case (affordable car insurance). Example, If you have an older automobile with fairly reduced worth, you might want to select a high deductible in order to keep your premiums lower.