How does full-coverage automobile insurance work? Complete protection car insurance is really 3 different types of protection; liability, collision and also thorough:: This protection deals with costs that can develop from mishaps you are accountable for, such as medical expenses as well as lawful fees.: This is an add-on that covers the repair work or replacement of your auto if you remain in an accident with one more lorry or a fixed things. affordable.

After that, there are some excellent factors to maintain full insurance coverage that are your own choice: You have a newer cars and truck Newer automobiles, specifically brand-new ones, have higher replacement costs than also one-year-old autos (vans). If you have a brand-new car as well as it's harmed or amounted to in an accident, you might pay a significant amount for its replacement without correct protection.

Should I drop part of my complete coverage? It's not necessary to completely eliminate full-coverage vehicle insurance coverage - cheap car. Collision and also comprehensive automobile insurance cover different hazards, and the danger of these risks happening can impact just how rewarding these coverage types are to you. Is accident insurance coverage required? The three major reasons to let go of crash insurance coverage are: Your vehicle isn't worth a whole lot.

You can manage car repair work or its substitute expense. Collision insurance coverage takes treatment of damages to your car if you struck another auto or stationary thing, such as a fencing or sign. It can likewise protect you in the occasion of a hit-and-run mishap. If you have an older cars and truck and also can pay for to replace it, consider going down collision coverage and keeping extensive protection.

Everything about Comprehensive Car Insurance: What Is It? - Liberty Mutual

Quote, Wizard (prices). com LLC makes no representations or guarantees of any kind of kind, reveal or implied, as to the procedure of this site or to the information, web content, products, or items included on this website. You expressly agree that your use this site goes to your single danger.

"Responsibility just" and also "complete coverage insurance:" these are most likely terms you've listened to considered prior to, but what do they imply as well as which degree of insurance coverage could be ideal for you? Adhere to along as we bust several of the most common obligation only misconceptions, answer your questions, and give you the understanding you need into these 2, typically confusing terms, so you can make the very best decision for you, your family members, as well as your automobile! The Inside information on Responsibility Just Insurance coverage Obligation just insurance coverage generally describes one of the most basic degree of insurance coverage that you can buy for your car (cheap auto insurance).

Together, these insurance coverages aid pay for the various other individual's medical expenses, lost earnings, car fixing, automobile substitute, and extra. While responsibility just protection will help you fulfill the legal demands in many states, it may not offer you a sufficient quantity of insurance coverage in the occasion of an accident.

laws affordable car insurance credit score cars

laws affordable car insurance credit score cars

Without coverage past responsibility only, you can be faced with huge repair work costs for the automobile you rely on every single day. insurance. The Misconception of "Full Protection" You will not see "complete coverage" detailed when it's time to get a quote. Despite what many individuals might believe, there's actually no such point! When people refer to "complete insurance coverage," they're usually describing a policy that includes the state-required bodily injury as well as home damage liability insurance, with each other with comprehensive and also accident protection.

Not known Facts About Car Insurance 101 - Car Insurance Faqs - The General ...

Comprehensive protection comes into play if your automobile is taken or damaged in an occasion various other than an accident (believe fire, flooding, rockslide, etc). Take into consideration that a policy that is explained as "full insurance coverage" would not cover: Your liability exposure if it is greater than the responsibility limitations you chose Insurance claims connected to an uninsured or underinsured motorist Your medical costs The quantity of any kind of deductibles you pick - consisting of for extensive & crash protections Events that are excluded under the plan That hardly seems "full," currently does it?

When choosing which might be best for you, it might be helpful to ask yourself these inquiries: A responsibility only plan with minimum limits has a tendency to be among the most affordable means to remain insured and also stay lawful while out on the roadway. Remember, your very own injuries or home damages are not covered with liability-only insurance policy - car.

Prior to making the call, however, it may be best to speak with your insurance representative about the prospective benefits and disadvantages to going this course (insure). The Cost of Responsibility Just Insurance Selecting responsibility just insurance coverage with minimal limits makes getting covered actually, really inexpensive, however is it right for you? Lean on one of our licensed insurance coverage representatives if you need help making the choice.

When it concerns insuring your cars and truck, there are a great deal of options when selecting the very best kind of protection for your scenario. With greater than half a century in the company of automobile insurance policy, numerous of our customers have actually asked us concerning the difference in between liability vs (trucks). complete protection insurance coverage.

The 7-Minute Rule for Do I Need Comprehensive Coverage Car Insurance Or Only ...

Every person has special requirements when it concerns auto insurance coverage which is why the experts at United Automobile Insurance Policy are right here to assist you every step of the means (trucks). When it pertains to liability vs. complete insurance coverage insurance coverage, allow's consider these different sorts of plans as well as see which one will ideal match your requirements to provide you tranquility of mind.

automobile perks insured car credit

automobile perks insured car credit

This sort of insurance only covers you in a crash for the injuries that you cause to people as well as property beyond your cars and truck. Let's check out an example. Throughout a snow storm, you move into an additional car at a traffic signal, which creates that car to strike a light post.

It will not pay for injuries to you, your travelers or any kind of damages to your very own vehicle. With responsibility just insurance policy, you would be directly responsible for these prices. Complete Insurance Coverage Cars And Truck Insurance Coverage - Shield Damages To Your Vehicle Also though full coverage is not a technical insurance policy term, it does an excellent work of explaining this details kind of plan.

Full protection vehicle insurance policy is more costly than an obligation just plan due to the fact that it consists of more advantages. As you assume about what is the ideal plan for you, maintain in mind that a required minimum degree of obligation insurance coverage is called for by regulation in both Illinois and Indiana. With that said said, here are some good guidelines concerning whether you need obligation only or complete coverage on your automobile. cheap car.

What Does Full Car Insurance Cover? - Kelley Blue Book - Truths

They will need complete insurance coverage because "technically" the automobile is still had by the financial institution or loan provider. You do not wish to be personally in charge of prices connected to a crash (other than a deductible). Your vehicle is new and also you intend to safeguard it in case of damage or theft.

You just need a policy that meets state mandated, minimal requirements. read more The Selection Is Yours For over half a century, United Automobile Insurance has actually been your one quit purchase all your insurance coverage needs. When it concerns responsibility vs. full insurance coverage insurance, we are prepared to help you find the best plan.

perks credit cheap auto insurance cheaper cars

perks credit cheap auto insurance cheaper cars

When you require aid choosing a responsibility vs (car). full protection plan, offer us a telephone call as well as Obtain A Totally Free Quote. We'll obtain you covered with the ideal insurance coverage strategy for you.

Picking the ideal insurance coverage is a large choice, and you may have some essential questions that need solutions. Of all the different kinds of auto insurance coverage, which offer the appropriate security for you?

How 2022 Best Cheap Car Insurance In Oklahoma - The Motley Fool can Save You Time, Stress, and Money.

They're not unless you add protection for those details products. Nearly every state needs motorists to bring responsibility coverage. Some states may need extra types of coverage such as uninsured/underinsured vehicle driver, medical repayments, or individual injury protection - affordable.

While you will not locate insurance policy to cover every cost you may incur, acquiring appropriate insurance coverage can assist secure you from a monetary loss due to an accident and numerous various other things that are past your control. If you reside in a state that just requires responsibility coverage, it can be tempting to skip the rest.

That doesn't include what you might need to pay for towing or leasing a car if your automobile is damaged - liability.

Automobile insurance policy terminology can be extremely complicated for Pennsylvania drivers. There are numerous terms that are similar, yet stand for entirely different points (business insurance). Complete tort protection and full coverage are two various insurance policy ideas. One is regularly misinterpreted for the various other, which can confirm pricey in the occasion of a cars and truck accident.

Rumored Buzz on What Is Full Coverage Car Insurance - Bankrate

Full insurance coverage insurance may also consist of responsibility insurance coverage. Find out Extra From An Experienced Lawyer Inevitably, the concepts of full tort protection and full protection need to be taken into consideration separately.

Automobile Policy Defense Automobile policies normally give the following kinds of insurance coverage: Physical Injury Obligation: Pays, approximately the limitations of the plan, for injuries to other individuals you cause with your vehicle. Home Damage Responsibility: Pays, approximately the limitations of the plan, for damages to other individuals's home triggered by your car.

It will pay for damage to your cars and truck triggered by crash or trouble. Comprehensive: Pays for damages to your auto caused by risks various other after that accident or trouble. Various other: There are other insurance coverage's such as towing and automobile leasing which may be offered (low-cost auto insurance).

However, business need to submit their prices and also types with us prior to they are applied. If the prices are fair, adequate, and not excessive or unjustly biased, the companies may utilize them. This permits competitors to exist as well as makes it possible for Indiana citizens to buy insurance coverage at a fair rate. The rates are open for public evaluation.

The Single Strategy To Use For What Is Comprehensive Car Insurance Coverage?

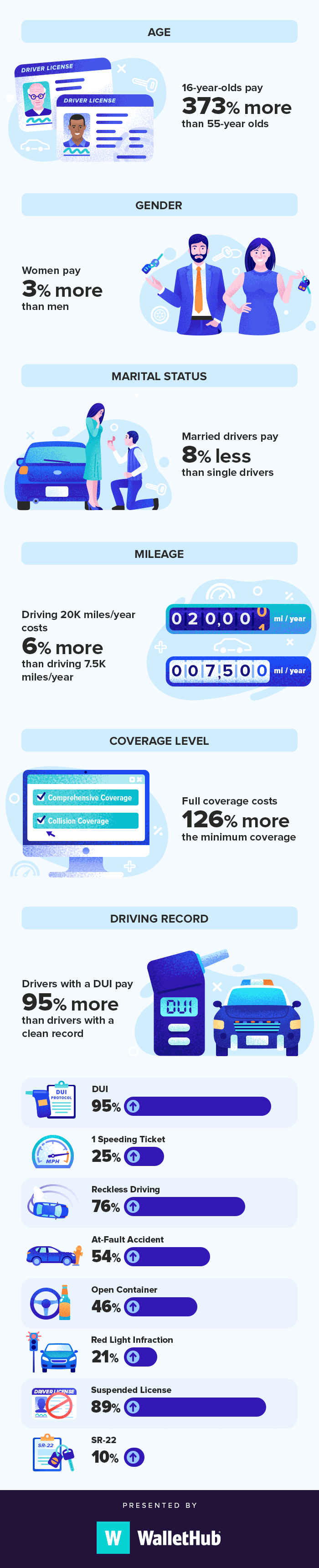

When comparing costs, make certain each company is estimating on the very same basis. The least expensive policy is not constantly the most effective policy. Some rating elements insurance coverage companies may use are: Age and also Sex Marriage Standing Chauffeur Record Vehicle Use Address Policy Boundary Deductibles Type of Vehicle Motorist Educating Cases Background Credit History Termination or Non-Renewal Constraints Insurance policy firms need to follow specific guidelines to cancel or non-renew an insurance coverage in Indiana.

What protection do I require? What coverage is included in my quote?

cheaper cars risks cheap auto insurance prices

cheaper cars risks cheap auto insurance prices

This insurance coverage shields the vehicle in the event of a claim and also since the leasing firm technically owns the automobile, they will require you to maintain this coverage. A "limited" policy is an optional recommendation that limits coverage under your plan to only those individuals who are particularly provided on your policy.