As soon as an insurance binder ends, it is no longer valid evidence of insurance coverage.

credit car insurance business insurance auto

credit car insurance business insurance auto

While you're researching automobile insurance coverage, an usual term that could turn up is an automobile insurance coverage binder. But what is a car insurance coverage binder, and do you require one? In this overview, our testimonial group responses this inquiry as well as others pertaining to the vital insurance paper. If you want getting vehicle insurance coverage or altering carriers, you can use the device listed below to gather and contrast cars and truck insurance coverage quotes from leading service providers. auto.

What Is A Vehicle Insurance Coverage Binder? An automobile insurance policy binder is a legal record provided by your insurer that gives short-term evidence of insurance policy protection. The auto insurance policy binder letter allows you to drive lawfully while the insurance coverage service provider validates your information and also prepares your main car insurance plan document. cheaper.

The main policy will generally show up before the car insurance policy binder runs out, but it never harms to call your insurance provider and ask when you will certainly obtain your authorities file - cheapest car. Once your automobile insurance policy binder expires, you are not technically covered with automobile insurance until your formal policy record and insurance coverage card has been released.

Rumored Buzz on Safety Insurance

It comes in handy to have an insurance binder accessible in instance you are drawn over by the authorities or have a mishap (prices). If you are financing your car, you will certainly need an insurance coverage binder to show your lender that you have actually obtained the amount of insurance coverage called for prior to the lender can accept your car loan. vehicle insurance.

It is a clever idea to ask your cars and truck insurance policy business where it will certainly be sending one to you prior to it comes. When you receive your insurance binder, your potential auto insurance coverage business is likewise taking a look at numerous points regarding you.

It might additionally pick to transform your car insurance price. car insurance. When your auto insurance coverage binder reaches its expiration day, you ought to call your automobile insurance policy firm to make certain that your formal plan has actually been provided.

Whenever Check out here you look for auto insurance coverage, you should get quotes from multiple insurance policy agencies so you can compare coverage as well as rates. In enhancement to the insurer you pick, variables such as your age, car make as well as model, and driving background can affect your costs, so what's finest for your neighbor may not be best for you.

Some Known Details About What Is An Insurance Binder? - Types, Coverages, Scenarios

The insurance company has an A+ BBB ranking and an AM Best financial toughness rating of A++. It owned over 13 percent of the 2019 car insurance coverage market share. With those high marks and also a variety of price cuts, Geico is a solid challenger for many motorists. For even more, read our Geico automobile insurance policy testimonial. cheaper car insurance.

auto affordable insurance cheaper

auto affordable insurance cheaper

/what-is-an-insurance-binder-proof-of-insurance-57afdfe85f9b58b5c2738def.jpg) business insurance cheaper car insurance cheapest car suvs

business insurance cheaper car insurance cheapest car suvs

Business get a rating in each of the following categories, as well as a total weighted score out of 5. Insurance companies with strong economic scores and also customer-first business practices obtain the greatest ratings in this group.

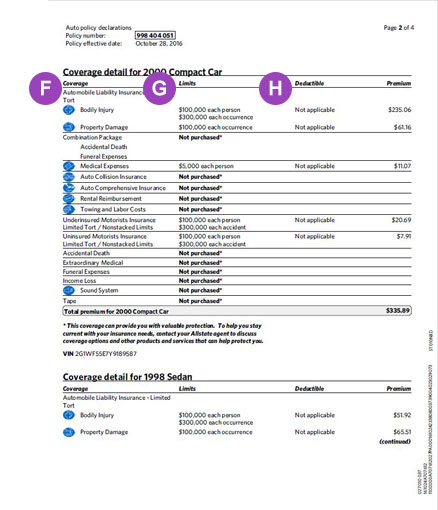

An insurance policy binder is a paper that acts as short-lived evidence of insurance policy coverage until a policy can be released. Your insurance binder will consist of information like the sort of policy, protection limitations, insurance deductible quantities and even more. Primarily, it must match the terms you and also the insurance provider agreed to when you got a policy.

This post covers everything you require to learn about insurance binders, including: What does an insurance policy binder include? An insurance binder includes every one of the essential info about an insurance coverage policy, like its protection limits and deductible amounts. It might not include some particular phrasing that will remain in your real policy, but it will certainly supply a summary of the vital points.

All About Cure Auto Insurance: Drive Well, Save More

Terms of insurance The most important aspect of your insurance policy binder is that it lays out the terms of your insurance coverage plan. Policy proprietor Your insurance binder should note the plan proprietor, or called insured, also.

If a pair acquires a house as well as it is in both of their names, the insurance binder ought to highlight both of them. If you're getting a car insurance policy for a financed automobile, the loan provider needs to show up in the document (cheapest). 3 (dui). Coverage restricts Two other elements your insurance binder should detail are the protection kinds and also restrictions that you and also your insurance provider set.

4. Residential or commercial property Something else an insurance policy binder includes is the risk or building the plan will cover. In a lot of cases, this is a cars and truck or home, though there are great deals of various other opportunities, too, like a motorbike or a watercraft. 5. Deductible quantity Your insurance coverage binder will identify the insurance deductible quantity for each kind of insurance policy you have.

6. Modifications or additions Changes or enhancements, also called insurance recommendations or cyclists, may likewise be stated in your insurance policy binder. Whether you're buying car or house owners insurance, it is very important that both are plainly specified in your insurance binder. cheaper cars. 7. Date of protection An insurance coverage binder ought to make the term of insurance policy clear.

What Does Auto-owners Insurance: Home Mean?

If you don't obtain your official policy prior to that day, contact your insurance company or agent. 8. Company as well as insurance policy agent Your binder will consist of the name of the insurer. It likewise needs to determine the person who accredited the binder, which need to be your insurance agent (vans). There's normally a disclaimer in this component of the message that states the binder undergoes the terms of the policy language, also.

cheapest car insurance insurance credit car

cheapest car insurance insurance credit car

It can take a few days to refine the paperwork and to complete underwriting. If your representative doesn't send you a binder, ask for one. Not just does it function as temporary evidence of insurance coverage, yet it likewise acts as verification of your insurance coverage strategy. Kinds of insurance binders You may receive an insurance binder for any type of sort of insurance coverage.

vehicle insurance low-cost auto insurance affordable auto insurance car

vehicle insurance low-cost auto insurance affordable auto insurance car

This is very important, as a lending institution will normally ask for proof of insurance when you most likely to purchase a house. As soon as the underwriting process is underway, your insurance firm will provide you a property owners insurance coverage binder that acts as evidence of coverage - car insurance. That document ends up being void after you get the official property owners insurance contract.

You can utilize your insurance coverage binder as evidence of insurance policy protection till your real plan gets here - cheaper. LLC has actually striven to make sure that the details on this site is right, however we can not ensure that it is without inaccuracies, errors, or noninclusions (cheapest car insurance). All web content and solutions offered on or through this website are given "as is" and also "as available" for use.

Fascination About Automobile Insurance Information Guide

com LLC makes no representations or guarantees of any kind, reveal or indicated, regarding the operation of this site or to the information, content, materials, or products consisted of on this website. You expressly agree that your use this website goes to your sole risk.